Financial Highlights

In 2016, we returned solid results despite facing many challenges in the global marketplace. Our business model, based on customer intimacy and a balanced approach to growth, continues to work well for Quaker.

Our cash at year end was $88.8 million— it exceeded our debt of $66.5 million by $22.3 million.

$100

80

60

40

20

0

Cash

Debt

Quaker has increased or maintained its dividend every year since going public in 1972.

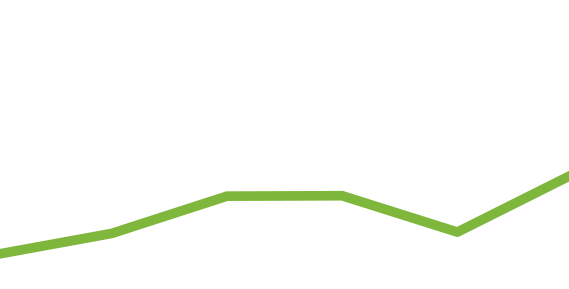

We’ve outpaced the major stock indices over the last five years. Quaker’s total

shareholder return has continued to significantly outperform—yielding a 243%

return to our shareholders since 2011.

COMPARISON OF CUMULATIVE FIVE-YEAR TOTAL RETURN (assumes an investment of $100 on December 31, 2011)

$400

350

300

250

200

150

100

50

Dec'11

Dec'12

Dec'13

Dec'14

Dec'15

Dec'16

- Quaker Chemical Corporation

- S&P SmallCap 600 Index

- S&P 600 Materials Group Index

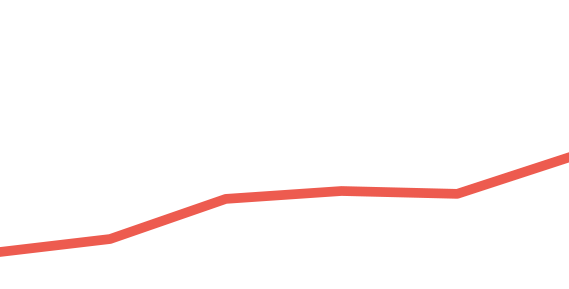

STOCK PRICE TREND (average share price in dollars)

$100

90

80

70

60

50

40

'12

Avg '13

Avg '14

Avg '15

Avg '16

Avg

Avg '13

Avg '14

Avg '15

Avg '16

Avg

Our stock attained the highest average price...ever. In 2016, our average stock price was $94.74 per share—up 14% compared to $83.29 per share in 2015.

NON-GAAP EARNINGS

PER DILUTED SHARE*

(share price in dollars)

$5.00

4.50

4.00

3.50

3.00

'12

'13

'14

'15

'16

Non-GAAP earnings per diluted share were strong—$4.60 in 2016 compared to $4.43 in 2015.

ADJUSTED EBITDA* (dollars in millions)

$110

100

90

80

70

60

'12

'13

'14

'15

'16

Our adjusted EBITDA grew to a record level—$106.6 million compared to $101.6 million in 2015.

*For reconciliation of non-GAAP items, see the Non-GAAP Measures section of Item 7 in Form 10-K for the years ended December 31, 2016, 2015 and 2014.